Want to avoid market fluctuations? Want to increase your income flow and leave a gift to Wheaton College? Gift Annuities may be for you!

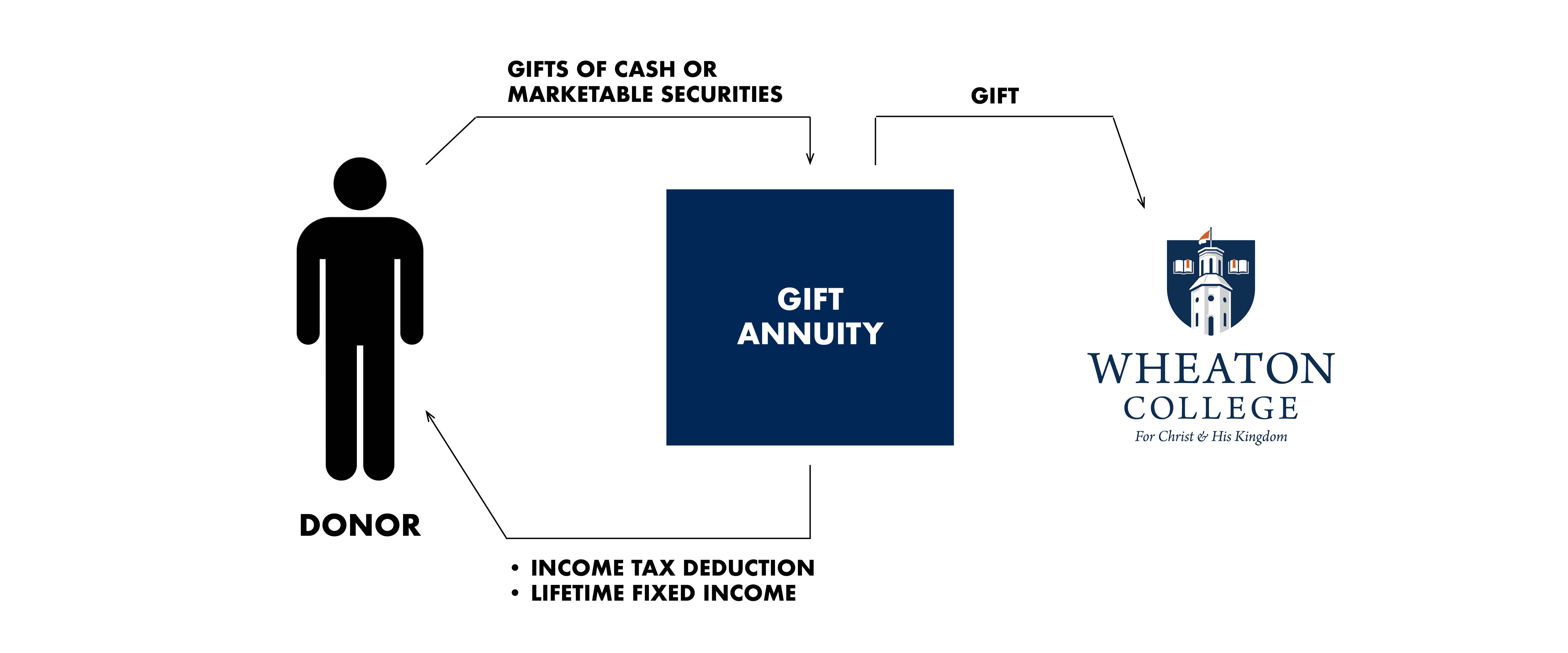

A gift annuity is funded with stock or cash. Fixed annuity payouts come to the donor for life and Wheaton receives the remainder after payments completed.

Benefits of a Gift Annuity

- Fixed payments for one or two people for life!

- Charitable income tax deduction for the charitable gift portion

- Payments may be partially tax-free

- Wheaton’s stability backs their gift annuities. Wheaton has offered gift annuities for 120 years!

- Further the work and ministry of Wheaton College

How a Charitable Gift Annuity Works

A charitable gift annuity is a contract between you and Wheaton.

- Cash or securities are transferred to Wheaton

- You complete an annuity application (link to it?) and Wheaton agrees to pay fixed payments to you for life confirmed in a contact.

- You will receive a partial income tax deduction for your contribution to the gift annuity, and your annuity payments will be partially tax-free.

- The gift portion furthers Wheaton’s mission!

- Minimum funding is $10,000, but income flow increases with higher funding amounts.

If you contribute appreciated stock, ETFs, or mutual funds to a gift annuity, you will partially avoid capital gains and stretch out recognition of any remaining capital gains over the life of your annuity payments.

IRA owners may fund a gift annuity from their IRA. Learn more about Qualified Charitable Distributions from your IRA.

Contact Us

If you have any questions about charitable gift annuities, please contact us at 630.752.5332 or gift.plan@wheaton.edu. We would be happy to assist you and answer your questions.

Additional Information

Current charitable gift annuity (payments begin within one year).

Payments to you begin promptly. With a current gift annuity, you may transfer cash or property in exchange for our promise to pay you fixed payments beginning as early as this year. You will receive an income tax charitable deduction this year for the value of your gift to Wheaton College.

Deferred charitable gift annuity (for payments at a future date).

You may want to wait and have payments start later and receive a higher payout rate. When you establish a deferred gift annuity, you fund it now and receive a charitable income tax deduction this year but defer the payments until a date in the future. A deferred gift annuity provides a higher payout.

Flexible deferred charitable gift annuity (gives you flexibility as to when the payments will start).

With a flexible deferred gift annuity, you may decide later when the annuity will begin making payments. You establish the annuity today and receive a charitable deduction this year, but the payments are deferred until you decide to begin receiving payments.