What is a Charitable Remainder Trust?

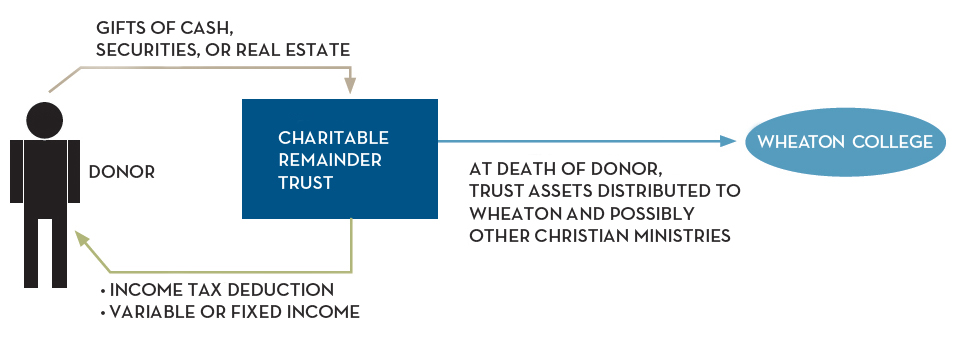

A charitable remainder trust enables you to receive income for life and avoid potential capital gains taxes and provides you with a current charitable income tax deduction. Real estate, cash, marketable securities, and closely held stock can all be transferred into the charitable remainder trust in exchange for lifetime income.

Since the trust is tax-exempt, when the trustee sells appreciated assets that have been transferred to it, the trust does not incur capital gains taxes. After a trust asset has been sold, the proceeds are subsequently invested in a diversified portfolio to provide you with lifetime income. At your death, the trust assets are distributed to Wheaton and potentially other charitable organizations which you support.

A charitable remainder trust is irrevocable and cannot be changed or revoked after it is created. However, the charitable beneficiaries may be amended as provided in the trust agreement.

What will a Charitable Remainder Trust do for me?

The principal advantages are as follows:

- Lifetime income stream

- Avoid potential capital gains taxes on appreciated assets

- Charitable income tax deduction

- Tax-free growth of trust assets

- Diversification of assets

- Significant gift to Wheaton College

Learn about the types of charitable remainder trusts

Request a For-Charitable-Remainder-Trust-Illustration